The first challenge faced by many medical device entrepreneurs and start-up companies is where to get funding to progress to the next stage. Grants, equity investments, loans, guarantees, and private venture capital are all available, but where do you find them?

We have put together this funding guide for early-stage and startup medical device companies. The guide is not intended to offer financial advice. Instead, it’s a roadmap to help you understand the funding opportunities that are available and are potentially worth exploring further.

Types of Medical Device Development Funding Available in Europe

- Non-dilutive grants – funding where there is no requirement to give up equity in the business. Grants typically do not have to be repaid, but there can be specific restrictions or requirements.

- Blended finance – funding that combines a grant and equity or repayable support.

- Loans and guarantees – funding that has to be repaid. Guarantees are typically offered by national governments to de-risk loan offerings.

- Equity and VC (venture capital) funding – where funding is offered in exchange for equity in the company.

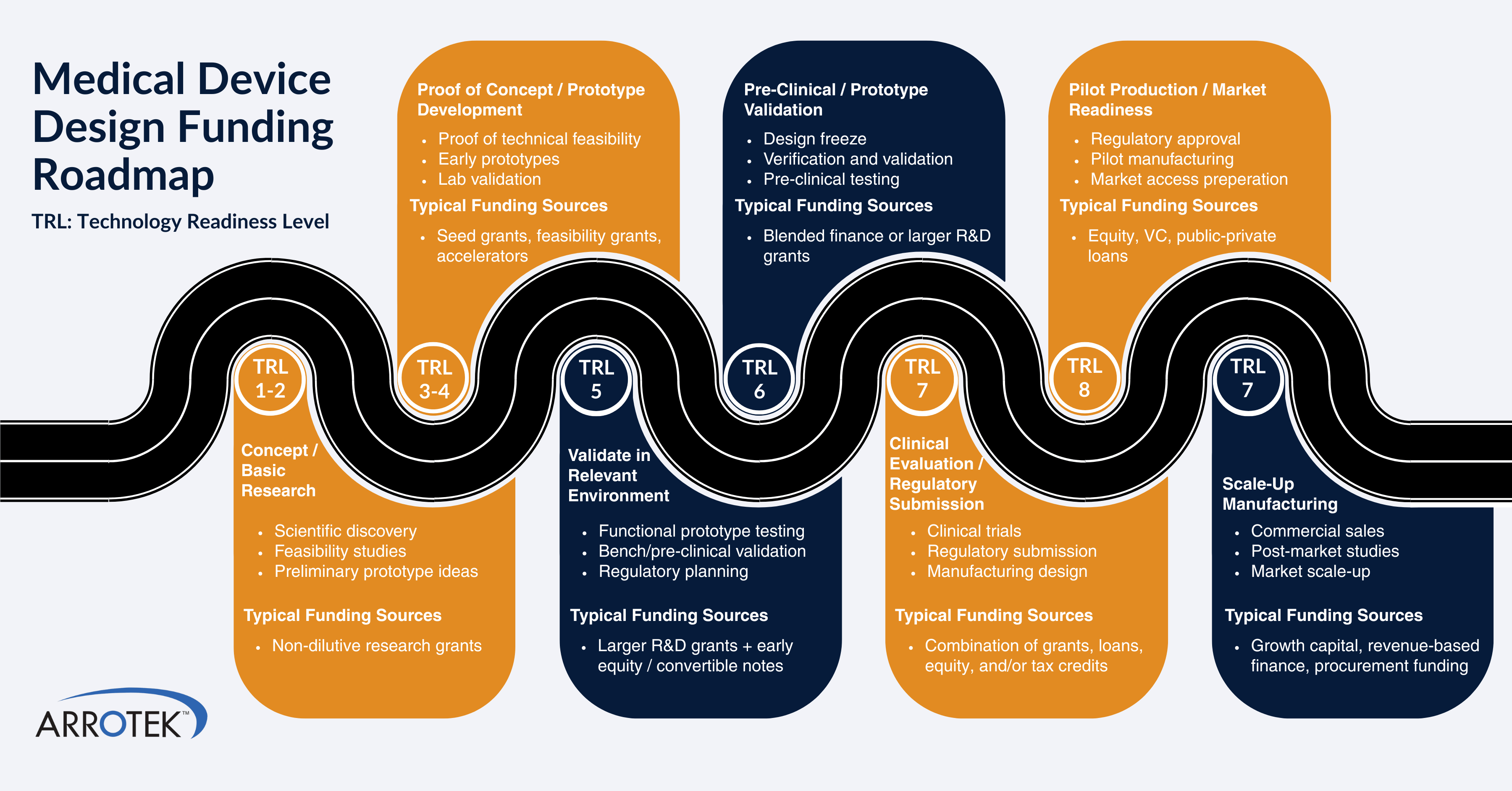

Technology Readiness Levels

- TRL 1 – basic principles are observed and reported.

- TRL 2 – basic principles are applied, and a concept is formulated.

- TRL 3 – an experimental proof-of-concept is established.

- TRL 4 – the basic technology is validated, often in a laboratory.

- TRL 5 – the technology is validated in a relevant environment.

- TRL 6 – the technology prototype is tested in a relevant environment.

- TRL 7 – the system prototype is demonstrated in an operational environment.

- TRL 8 – the system is proven to be successful in its operational environment.

- TRL 9 – the technology is proven to be successful in a real-world operational environment.

Quick Tips for Exploring Medical Device Development Funding Opportunities

- Match your current TRL to the programme

- Combine EU and national funding, such as using national grants for early R&D and then EU funding for scale-up and growth.

- Look for health-specific calls, i.e., funding opportunities with specific requirements connected to your idea or product.

- Don’t forget regional funds and European Regional Development Funds that can help in areas like manufacturing scale-up, cleanroom development, and equipment.

Grant Funding Sources

EU / Pan-European Level

Horizon Europe

Horizon Europe is the EU’s main funding program for research and innovation projects. It runs until 2027, but there is a replacement Horizon Europe 2028 – 2034 proposal currently in consultation with a €175 billion budget. The primary programs offering funding for the development of new medical devices include:- European Innovation Council (EIC) grants

- Cluster 1: Health collaborative projects

- The Innovative Health Initiative

- EIC Pathfinder – suitable for early-stage (TRL 1-4) R&D projects. Grants of up to €4 million are available.

- EIC Transition – suitable for mid-stage (TRL 3-6) project. Grants of up to €2.5 million are available for technology validation and business case development.

- EIC Pre-Accelerator – suitable for projects at TRL 4-6. Grants of up to €0.5 million are available to support technology, business, and investment readiness.

- EIC Accelerator – suitable for scale-up projects (TRL 6-8). Both grants (up to €2.5 million) and equity investments (up to €10 million) are available. Note that UK companies are only eligible to apply for the grant component.

EU4Health

Separate from Horizon Europe, EU4Health is the EU’s funding program focused on priorities that include:- Health crisis preparedness in the EU

- Health promotion and disease prevention

- Health systems and the healthcare workforce

Eurostars

Eurostars is a funding program from EUREKA, an intergovernmental organization that supports market-driven R&D and innovation. Its funding comes from public bodies of its member countries. There are 47 member countries, including all 27 EU countries. Funding is available for SME-led, market-driven medical device development projects for R&D activities typically up to TRL 6. The amount and type of funding available are determined by the national bodies within the Eurostars network.InvestEU

InvestEU doesn’t directly provide financial support for medical device projects and SMEs. Instead, it offers public guarantees to help SMEs secure investment from private and institutional sources. An example is the French hospital and hygiene solution provider Germitec. It secured a €25 million investment from the European Investment Bank (EIB) in 2023 that was underpinned by an InvestEU guarantee.Country-Specific Grant Funding Sources

Ireland

- Enterprise Ireland – offers equity investments and tailored grants. Program examples include the Disruptive Technologies Innovation Fund (DTIF), which publishes regular funding proposal calls.

United Kingdom

- Innovate UK – grants and other supports for research and innovation via a range of investment areas. This includes the Biomedical Catalyst, which supports health technology projects with accelerator grants, industry-led R&D grants, and investor partnerships.

- National Institute for Health and Care Research – offers a range of funding opportunities to support research in health, care, and public health. This includes the Invention for Innovation (i4i) programme that supports research for medical device projects.

France

- Bpifrance – offers grants, loans, and public VC, including specific biotechnology and medical device VC funds.

Germany

- Zentrales Innovationsprogramm Mittelstand (ZIM) – national R&D grants for SMEs.

Netherlands

- Netherlands Enterprise Agency (RVO) – offers support, including financial support, for projects that contribute to good health.

Sweden

- Swedish Innovation Agency (Vinnova) – regularly publishes specific funding opportunities, including for medical device development projects.

Denmark

- Innovation Fund Denmark (Innovationsfonden) – supports research and innovation projects via a range of programs.

- Danish Export and Investment Fund (EIFO) – co-financing solutions for Danish companies.

Norway

- Innovation Norway – offers a range of supports for start-up companies, including grants and loans.

- The Research Council of Norway – provides R&D funding through regular calls for proposals. Health is one of its 11 investment portfolios.

Switzerland

- Swiss Innovation Agency (Innosuisse) – provides financial and advisory support for science-based innovations.

Austria

- Austrian Research Promotion Agency (FFG) – funding for R&D and innovation projects, including life sciences and health projects.

Belgium

- VLAIO – funding and other supports directly from VLAIO and its partner network.

- Innoviris – co-financing opportunities for science-based projects.

Spain

- Centre for the Development of Industrial Technology (CDTI) – loans and grants for industrial R&D. CDTI also runs national MedTech calls and participates in Eurostars.

- Instituto de Salud Carlos III – manages an annual call for proposals for funding to support health-related R&D projects.

Italy

- Ministry of University and Research (MUR) – funding programs for research projects.

- Invitalia – Italy’s national development agency that manages European and national business start-up funds.

Poland

- National Centre for Research and Development – co-financing, grants, and seed funding for science-based projects.

Private and Hybrid (public + private) Venture Capital Funds

EU-Wide VC Companies

- Sofinnova Partners – based in France, Sofinnova Partners is one of Europe’s leading life-science VCs.

- Wellington Partners Life Sciences – German-based EU-wide VC investing in early-stage and growth-stage life sciences companies.

- EQT Life Sciences – pan-EU VC and one of Europe’s largest investors in life sciences.

- Gilde Healthcare – Netherlands-based healthcare investor that is active across Europe and the US.

- Andera Partners – France-based private equity firm that invests in EU and US medical device companies through its andera Life Sciences program.

- Seroba Life Sciences – Ireland-based life sciences venture capital company that invests in MedTech and biotech innovations across the EU and UK.

- MTIP – based in Switzerland, MTIP invests in healthcare software innovations across Europe.

- Truffle Capital – based in France, Truffle Capital invests in MedTech companies through its BioMedTech fund.

- Kurma Partners – invests in healthcare and biotechnology companies across Europe.

- Earlybird Health – Germany-based healthcare investor focused on early-stage founders across Europe.

- Forbion – EU-based global venture capital firm investing in life sciences innovation.

Country Specific VC Companies

UK

- Parkwalk Advisors – university spin-out investor with a life science and MedTech portfolio.

- Cambridge Innovation Capital – Series A investor in MedTech within the Cambridge ecosystem.

- IP Group – invests in science and technology businesses, including medical devices.

- Oxford Science Enterprises – an investment company with a strategic partnership with the University of Oxford.

- Northern Gritstone – invests in science innovations from the North of England.

- AlbionVC – early-stage healthcare investor.

- Downing Ventures – invests in healthcare companies.

- Mercia Asset Management – provides venture capital, loans, and private equity.

Ireland

- Fountain Healthcare Partners – invests in medical device, pharma, biopharma, and diagnostic companies.

- Delta Partners – early-stage funding for Irish startups.

- HBAN MedTech Syndicate – angel network for early seed rounds.

Spain

- Ysios Capital – leading life sciences investor.

- Asabys Partners – investor in healthcare and life sciences innovations.

- Ship2B Ventures – invests in impact startups focused on improving the quality of life for vulnerable groups.

- Nina Capital – specialises in investing in companies at the intersection of healthcare and technology.

Italy

- Panakès Partners – leading Italian MedTech and life sciences VC.

- Indaco Venture Partners – a large Italian VC that invests in medical device companies through its Indaco BIO fund.

- Claris Ventures – invests in early-stage Italian life sciences companies.

- Vertis SGR – invests in healthtech companies through private equity and venture capital.

Germany

- High-Tech Gründerfonds – pre-seed and seed investor for high-tech life sciences startups.

- MEDCAP Capital – invests in life sciences companies in Northern Europe.

- MIG Fonds – a venture capital firm that invests in life sciences companies.

- Bayern Kapital – a venture capital investor that invests in medical device startups.

France

- Elaia Partners – invests in biotechnology companies.

Denmark

- Sunstone Life Science Ventures – invests in life sciences and therapeutics innovations.

- Novo Holdings – international life sciences investor.

- Lundbeckfonden Ventures – a venture capital fund that invests in life sciences companies.

Medical Device Funding FAQs

What types of funding are available for early-stage medical device startups in Europe?

Startups in Europe can potentially access a mix of public and private funding depending on their stage of development. Common sources include EU grants from Horizon Europe and grants from national innovation agencies such as Enterprise Ireland and Innovate UK. Other sources of funding include regional development funds and private investment from angel networks or venture capital. Many startups pursue grant funding before equity investment.

Where can I find grants specifically for medical device development?

EU-level programs such as Horizon Europe and the EIC Pathfinder and Accelerator programs offer funding for innovative medical technologies. Additionally, national funding bodies such as Innovate UK, VLAIO (Belgium), or CDTI (Spain) offer funding, often by publishing calls targeting health tech innovation.

Do I need a prototype or clinical data before applying for funding?

It depends on the funding stage. Early-stage programs such as EIC Pathfinder or some national feasibility grants can support concept validation and early prototype development. However, later-stage funding, such as the EIC Accelerator program, can require a working prototype along with other requirements (for example, initial safety testing and a clear regulatory plan).

How can I improve my chances of getting funded?

- Clearly articulate how your device addresses an unmet medical need and aligns with EU / program / fund health priorities.

- Demonstrate an awareness of MDR requirements, potential reimbursement routes, and your commercialization strategy.

- For EU programs, partnering with academic or clinical organizations across member states can strengthen your application.

- Partnering with a medical device development company can also help, as you will receive technical guidance and information that can support your application.