The United States is home to the world’s largest medical device industry, so there is an extensive range of funding opportunities to support startups and the development of new products. This includes government, commercial, and non-profit sources of funding.

The suitability of the various medical device funding opportunities in the USA depends on a range of factors. This includes the type of product you are developing, where you are based, your technology readiness level, and the type of funding structure you are comfortable with pursuing. For example, are you willing to give up equity in your company in exchange for funding?

Most medical device development projects progress using a range of funding types from multiple sources.

In our guide to medical device funding opportunities in the U.S., we look at everything from government-backed grants to specialist venture capital firms to alternative sources of funding.

Table of Contents

Technology Readiness Levels

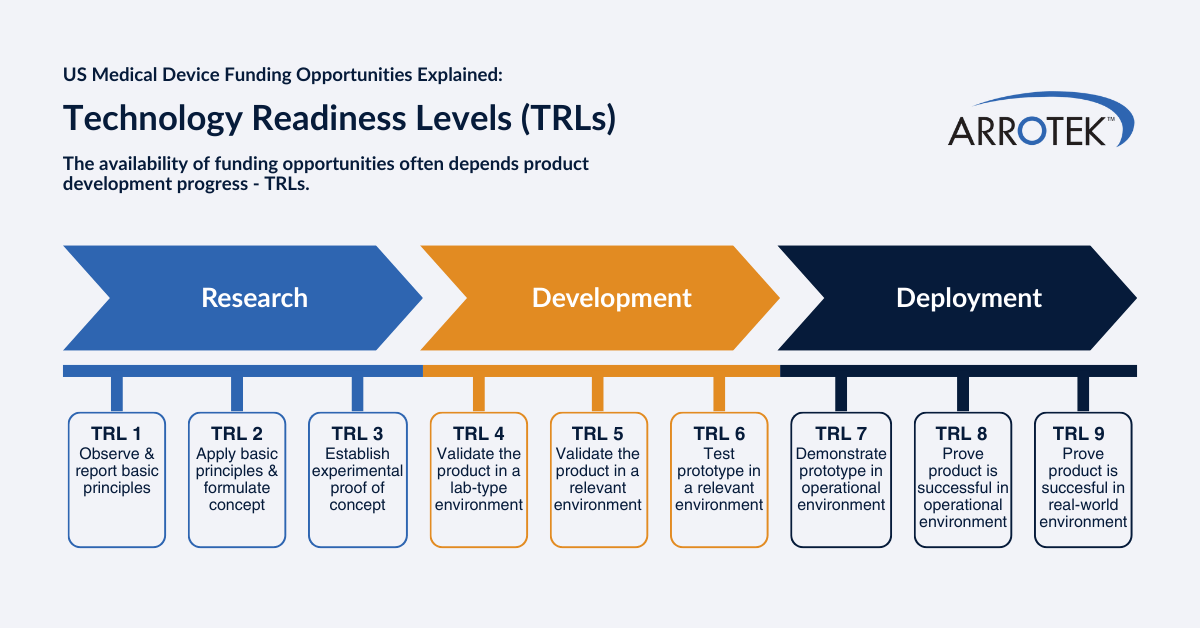

Most funding bodies and organizations in the U.S. use technology readiness levels (TRLs) to determine projects to consider and support. TRLs describe the maturity of your project from the development of basic principles at TRL 1 up to TRL 9, where the product is proven in real-world operational environments.

The Main Sources of Medical Device Development Funding in the U.S.

- Federal government and public sector funding

- State and local funding

- Private investment from venture capital firms and angel investors

- Corporate and strategic partnerships

- Accelerators, incubators, and innovation programs

- Nonprofit and philanthropic funding

- Alternative and emerging funding options

Federal Government and Public Sector Funding

NIH Grant Opportunities

A good starting place to search for health-related funding opportunities is the National Institutes of Health’s (NIH) Grants and Funding website. The NIH describes itself as the world’s largest public funder of biomedical research.

The Grants and Funding section of its website lists hundreds of grants and awards funded by the NIH as well as other government agencies. Examples include the Centers for Devices and Radiological Health (CDRH) and the Department of Health and Human Services (DHHS).

Active funding programs can be searched using a range of filters to identify relevant opportunities.

All the funding opportunities posted to the NIH Grants and Funding website are also posted to the U.S. government’s central portal of funding opportunities, Grants.gov.

SBIR and STTR

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are awarded by America’s Seed Fund and coordinated by the Small Business Administration (SBA).

SBIR and STTR are highly competitive federal grants for businesses in early-stage R&D. The grants are not specifically aimed at the MedTech sector, but they have historically been one of the largest sources of non-dilutive early-stage funding for medical device companies (non-dilutive funding is access to funds without the need to give up an equity stake in the company).

The funding available through the SBIR and STTR programs comes from participating federal agencies, including Health and Human Services (HHS) and the National Science Foundation (NSF). The NIH has also been a participating federal agency in the past. However, at the time of writing, the NIH is not currently accepting applications as the legislative authority expired in October 2025. Check the NIH’s website for the latest developments.

Both SBIR and STTR have three common phases:

- Phase I — Feasibility and proof-of-concept

- Phase II — Research and prototype development

- Phase III — Commercialization

Advanced Research Projects Agency for Health

Advanced Research Projects Agency for Health (ARPA-H) funds “high-impact, innovative health research” with the aim of significantly improving health outcomes. ARPA-H issues solicitations known as Innovative Solution Openings (ISOs) in addition to other funding opportunities. While aimed at the health sector overall, the ARPA-H is open to innovative medical device development projects that meet the criteria of its ISOs and other opportunities.

BARDA

The Biomedical Advanced Research and Development Authority (BARDA) is a US government agency focused on the development and procurement of medical countermeasures. The main focus areas include:

- Addressing the health impacts of CBRN (chemical, biological, radiological, or nuclear) accidents, incidents, and attacks.

- Pandemic influenza

- Emerging infectious diseases

BARDA funding opportunities become available through the publishing of Broad Agency Announcements (BAAs) and EZ-BAA programs. While not targeted specifically at the medical device industry, they can include devices.

BARDA also offers partnership opportunities for established, proven, and innovative businesses.

NIH Common Fund

The National Institutes of Health Common Fund supports high-impact health initiatives. While not device-specific, some Common Fund initiatives can enable the development of foundational tools or technologies used in medical device innovation.

FDA CDRH Innovation Grants & Assistance

The U.S. Food & Drug Administration’s (FDA) CDRH runs targeted programs to assist the development of innovative medical devices. The programs enhance communication and collaboration with the FDA to potentially streamline the regulatory approval process when your project gets to that stage.

So, while not a funding opportunity as such, there are potential regulatory-related time and cost savings.

State and Local Funding

State and local funding for medical device development is highly fragmented in the US. That said, state and local funding opportunities often play an important role in bridging early gaps in the development process, such as the gap between receiving a federal grant and embarking on your first VC (venture capital) round.

In this part of the guide, we are going to give a general overview of potential funding sources before drilling down further into selected states with significant medical device industries.

SBIR/STTR Matching Programs

There are a number of U.S. states that match federal SBIR and STTR awards, extending the amount of grant funding potentially available. Examples include:

- Massachusetts MassVentures START / SBIR Targeted Technologies

- Kentucky SBIR/STTR Matching Funds

- Florida High Tech Corridor

- Illinois Department of Commerce and Economic Opportunity

State Innovation Funds

Many states in the U.S. also offer direct grants in the form of innovation funds. They are typically competitive and milestone-based awards. Examples include:

- Maryland TEDCO Seed & Gap Funds

- New York Empire State Development Innovation Programs

- Colorado Advanced Industries Accelerator

- California iHub / GO-Biz programs

- Georgia Research Alliance Venture Fund

- Ohio Third Frontier

State Economic Development Grants

Commercialization-focused grants are offered by a range of states across the U.S. They are typically administered by state economic development agencies, quasi-public innovation authorities, or public-private partnerships. They typically require you to have operations in the state, as well as job creation or capital investment milestones. Examples include:

- Pennsylvania Ben Franklin Technology Partners

- Georgia Research Alliance Venture Development

- Michigan Business Development Program

- North Carolina One North Carolina Fund

- North Carolina Biotechnology Center

- Minnesota Department of Employment & Economic Development grants

Regional Technology and Innovation Hubs

Regional Technology and Innovation Hubs (Tech Hubs) are federal funding programs that are administered locally at the state and regional level. They are not MedTech-focused but can include opportunities for MedTech companies. Current opportunities are posted on the U.S. Economic Development Administration (EDA) website.

Other Potential State and Local Medical Device Funding Opportunities

Some cities, counties, and regions across the U.S. also offer funding opportunities. They are typically smaller in value but are also less competitive and can fund things such as early prototyping or feasibility studies. It is worth searching online for innovation challenge grants, economic development loans, or tech hub funding in your city, county, or region.

Tax incentives are also offered by some states. While this is not cash funding, the value can be significant. They can also help reduce the cash burn rate, which is a major challenge for many medical device startups. Examples of the tax incentives that might be available in your state or local area include:

- R&D tax credits

- Payroll and job creation credits

- Sales tax exemptions

Low-interest loans are also available in some states for things like working capital, equipment purchases, and pilot manufacturing. Interest rates are often lower than 4%. Features can include grace periods and long repayment horizons. To find relevant opportunities, search for the following types of programs and initiatives in your state, city, or region:

- State economic development loan funds

- Technology development revolving loan programs

- Local development authorities

- Public infrastructure banks

Finally, universities can offer funding programs, especially if your medical device idea originated in academia.

Massachusetts Focus

Medical device development funding opportunities in Massachusetts include:

- Massachusetts Life Sciences Center (MLSC) – the primary quasi-public agency driving funding for life science innovation in the state.

- M2D2 $200K Challenge – in-kind services and cash awards for disruptive medical technology companies.

- MA TechHubs – an economic development initiative focused on specific regions within Massachusetts. Regions designated as TechHubs receive grants for infrastructure and strategy development to support local innovation capacity.

- MassVentures START – Massachusetts’ venture arm that invests in innovative companies, which can include MedTech.

Illinois Focus

Medical device development funding opportunities in Illinois include:

- mHUB Chicago – Chicago innovation center with a MedTech Accelerator offering cash investments, hands-on support, access to equipment, and more.

- Illinois Innovation Voucher Program – grants to help SMEs collaborate with universities and research institutions in Illinois.

- MATTER – a healthcare incubator that can help connect MedTech startups with funding opportunities.

- Illinois Growth and Innovation Fund – investment fund targeted at tech-enabled companies (including health and device tech) located or significantly operating in Illinois.

- Illinois INVENT – an innovation venture fund aimed at improving access to early-stage capital with a specific focus on socially and economically disadvantaged entrepreneurs.

- Illinois Angel Investment Tax Credit Program – a program to encourage investment in MedTech companies through tax incentives.

The Illinois Department of Commerce and Economic Opportunity also regularly publishes a range of grant opportunities available in the state.

State Funding Opportunities Tips and Strategies

As mentioned previously, state funding opportunities vary depending on where you are located, so local research is recommended. Tips and strategies to help with the process include:

- In the early stages of your project, state funding is often the fastest to obtain.

- SBIR matching is one of the highest ROI funding sources if it’s available in your area.

- Tax credits quietly and effectively extend your financial runway without any dilution of company equity.

- Loans work best in post-prototype, pre-revenue stages of product development.

- Location matters. For example, moving a company’s headquarters to a neighboring state can materially change the funding opportunities that are available.

Venture Capital Firms Investing in U.S. MedTech Companies

OrbiMed

OrbiMed is one of the world’s largest dedicated healthcare investment firms. It has billions under management and a long track record in biotech and MedTech.

Polaris Partners

Polaris Partners is a Boston-based VC with a strong life sciences focus. It invests in medical devices, diagnostics, healthcare tools, and bio-innovation.

Versant Ventures

Versant Ventures invests specifically in healthcare and life sciences, including MedTech and medical devices.

Frazier Healthcare Partners

Frazier Healthcare Partners is a healthcare-focused private equity and venture capital firm. It invests in MedTech, digital health, therapeutics, and other health sectors.

Venture Investors

Venture Investors Health Fund is a Wisconsin-based early-stage health and technology VC with a strong focus on medical devices and diagnostics.

BioGenerator Ventures

BioGenerator Ventures is the venture capital arm of Missouri-based investment firm BioSTL. It has a deep focus on life sciences and medical technologies.

ARCH Venture Partners

ARCH Venture Partners is one of the most active healthcare investors in the US. It’s mostly associated with biotech, but it also invests in MedTech innovations.

Bain Capital Life Sciences

Bain Capital Life Sciences is part of Bain Capital’s broader investment platform. It invests in healthcare technologies, including providing later-stage MedTech growth funding.

Novo Holdings

Novo Holdings is a large, international life sciences investor active in the U.S. It participates in major MedTech rounds, including clinical-stage device companies.

Norwest Venture Partners

Norwest Venture Partners is a multi-sector VC that participates in healthcare and MedTech financings. This includes medical devices and health tech platforms.

Other VC Opportunities

In addition to the above, there are other VC firms that are not specifically health sector or MedTech focused but that do invest in medical device companies and innovations. VCs to investigate further include:

Angel Investors and Angel Groups That Support U.S. MedTech Companies

Angel Investment Networks and Syndicates

Syndicates and networks worth exploring for MedTech investments include:

Ecosystem-Linked Angels

Many MedTech startups raise early funding from angel networks connected to university tech transfer offices or regional innovation hubs. Examples include:

Corporate and Strategic Partnerships

Corporate partners are typically well-established large medical device or health sector companies. In addition to capital investment, they can also offer other types of support:

- R&D collaboration

- Regulatory support

- Clinical expertise

- Commercialization support

- Manufacturing and supply chain support

The table below shows the main types of engagements offered by corporate partners:

| Type | Description | Benefits |

|---|---|---|

| Corporate Venture Capital | Direct equity investment from a MedTech or Pharma company’s VC arm | Funding, mentoring, co-development opportunities, credibility with other investors |

| Co-Development / Licensing Deals | Jointly develop the technology or license it to a corporate partner | Non-dilutive revenue via upfront fees or milestone payments, shared resources for regulatory/clinical testing |

| Strategic Partnerships / Pilot Programs | Deploy the technology in the corporate partner’s facilities or partner with their clinical network | Real-world validation, access to clinical data, proof-of-concept validation for regulators and investors |

| Mergers & Acquisitions (M&A) Preparation | Corporate partners may acquire the startup after proof-of-concept or commercialization | Exit opportunities, scale-up, expanded resources, global distribution access |

| Joint Ventures | Shared ownership of a product or platform, often with shared IP | Shared risk, combined technical and market expertise, co-funding of development |

Companies active in setting up corporate and strategic partnerships with medical device SMEs and startups include:

- Boston Scientific Ventures

- Johnson & Johnson Innovation – JJDC

- Pfizer Ventures

- Roche Venture Fund

- Novartis Venture Fund

- Sanofi Ventures

- GE Ventures (Healthcare)

- Philips HealthTech Ventures

Tips for approaching potential corporate partners, such as those in the above list, include:

- Identify alignment – look for companies with product portfolios that complement your device or technology.

- Leverage clinical or technical data – use early prototypes, pilot studies, or regulatory submissions to help attract interest.

- Target strategic investors early – this is especially beneficial if your technology or device requires hospital adoption or complex clinical integration.

- Be open to multiple deal structures – investment, licensing, co-development, or pilot programs can all lead to growth and the achievement of your objectives.

Accelerators, Incubators, and Innovation Programs

MedTech Innovator

MedTech Innovator is one of the world’s largest MedTech‑specific accelerators. It provides a range of support options for medical device, diagnostic, and digital health companies.

JLABS by Johnson & Johnson

JLABS by Johnson & Johnson is a global network of health care incubators that provides early-stage startups with capital-efficient lab space, mentorship, and industry connections.

Mayo Clinic and ASU Alliance for Health Care Accelerator

The Mayo Clinic and ASU Alliance for Health Care Accelerator is a specialized MedTech accelerator operated through an alliance between the Mayo Clinic and Arizona State University.

Massachusetts Medical Device Development Center

Massachusetts Medical Device Development Center (M2D2) is a joint initiative between UMass Lowell and UMass Chan Medical School that provides coordinated access to engineering expertise, clinical trial resources, and specialized incubator space.

mHUB MedTech Accelerator (Chicago)

The mHUB MedTech Accelerator in Chicago provides funding and other hands-on support services to help MedTech startups turn product ideas into scalable businesses.

Global Center For Medical Innovation

The Global Center for Medical Innovation is an Atlanta-based incubator affiliated with Georgia Tech that provides a range of supports to medical device startups.

VentureWell

VentureWell is a hybrid accelerator that helps prepare MedTech and device startups for partnerships and investment.

Health Wildcatters

Health Wildcatters is seed accelerator based in Dallas that provides early-stage healthcare startups with seed funding, training, and access to a network of over 200 industry-specific mentors.

Texas Medical Center Innovation

Texas Medical Center Innovation offers accelerators and innovation programs, including the HealthTech Accelerator.

MATTER

Matter is a Chicago-based incubator that supports MedTech startups by fostering collaboration between entrepreneurs, industry leaders, and clinicians.

ExploraMed

ExploraMed is a venture‑backed incubator dedicated to transformative medical device solutions.

Fogarty Innovation

Fogarty Innovation is a Silicon Valley-based non-profit educational incubator that provides early-stage medical device startups with hands-on mentorship and clinical access.

ZeroTo510

ZeroTo510 is a Memphis-based medical device accelerator that helps early-stage startups by providing seed funding, mentorship, and access to Memphis’s medical manufacturing ecosystem.

The Foundry

The Foundry is a Silicon Valley-based medical device incubator that helps startups working on products aimed at significant unmet clinical needs in fields such as cardiovascular and ophthalmic health.

Nonprofit and Philanthropic Funding

Nonprofit and philanthropic funding is an often effective but sometimes underutilized source of support for MedTech development in the U.S. This type of funding is typically provided as grants, awards, or programmatic support. They focus mainly on early-stage, high-risk, or socially impactful medical device projects.

Unlike VCs or corporate partners, they usually do not take equity. Instead, nonprofit and philanthropic providers of funding focus more on public health impact, underserved populations, or innovative solutions that may not yet be commercially viable.

Examples of organizations that offer nonprofit and philanthropic funding include:

- American Heart Association (AHA) Innovative Project Awards – example projects include novel cardiac devices and remote monitoring tools.

- Michael J. Fox Foundation for Parkinson’s Research – example projects include wearable sensors and neuromodulation devices.

- Cystic Fibrosis Foundation – example projects include diagnostic devices, monitoring tools, and inhalation devices.

- Breakthrough T1D – example projects include continuous glucose monitors and closed-loop insulin delivery devices.

- CIMIT (Consortium for Affordable Medical Technologies, Boston) – example projects include low-cost surgical tools and point-of-care diagnostics.

- BioAccel – example projects include device prototyping, preclinical studies, and pilot trials.

- Cures Within Reach – example projects include diagnostic and monitoring devices for rare diseases.

- Children’s Hospital Foundation / Boston Children’s Innovation & Digital Health Programs – example projects include pediatric device development and early-stage digital/diagnostic tools.

- Stanford SPARK Program – seed funding for medical technologies mostly emerging from Stanford labs.

- Cleveland Clinic Innovations – example projects include innovation development and pilot testing.

- Capillary Foundation – example projects are diverse, with funding potentially open for any type of new medical device development project.

- Children’s Tumor Foundation – disease-focused non-profit that funds research into neurofibromatosis (NF). Primarily aimed at drug discovery and clinical research, but foundations such as this are often open to exploring opportunities for relevant biomarker tools, diagnostics, and device technologies.

- Michelson Medical Research Foundation – example projects include cutting‑edge biomedical technologies in immunology and other fields.

In addition to the above, there are also broader philanthropic funders that can support medical device innovation. Examples that are worth exploring further include:

- Howard Hughes Medical Institute

- Bill & Melinda Gates Medical Research Institute

- Health Research Alliance

- American Cancer Society

- Patient‑Centered Outcomes Research Institute

- Acumen Fund

- Global Innovation Fund

Best Practices When Engaging with Philanthropic Funders

- Map your device to a health mission, as foundations often prioritize projects that address specific disease or public health goals.

- Leverage clinical validation and data to clearly demonstrate patient impact or clinical utility.

- Partner with academic or clinical collaborators, as many nonprofits provide funding through university or hospital partnerships.

Alternative and Emerging Funding Paths

Revenue-Based Financing

With Revenue-Based Financing (RBF), medical device startups receive capital in exchange for a fixed percentage of future revenues rather than giving away equity in the company. In addition to no dilution of equity, there is also flexibility on repayments, as repayments are linked to revenues.

RBF providers include:

Crowdfunding

Crowdfunding typically involves using an online platform to raise small investments from large numbers of backers. This funding source has limited potential for complex medical devices with FDA approval requirements, but it can be suitable for some projects.

Prize and Challenge-Based Funding

Price and challenge-based funding is where organizations set up competitions where cash is awarded for solving a specific healthcare problem. Examples include:

FAQs

What are the main sources of funding for medical device development projects in the U.S.?

Medical device development projects in the U.S. are typically funded by a mix of sources, i.e., hybrid funding. The main funding options include federal grants, state innovation programs, venture capital, angel investors, corporate partnerships, accelerators, and nonprofit organizations.

Are there federal grants specifically for medical device companies?

There are several federal agencies that fund medical device innovation. Examples include NIH, BARDA, and ARPA-H. These programs typically support early-stage R&D, prototyping, translational research, and clinical feasibility. They are often competitive but are typically awarded on a non-dilutive basis, so there is no requirement to give up company equity.

Can startups and small companies apply for federal medical device funding?

Yes. In fact, many federal programs are designed specifically for small businesses and startups, including early-stage companies that have not yet raised venture capital. Eligibility requirements vary by agency and program, but there are opportunities for startups and small companies.

Do states offer funding programs for medical device development?

Yes, although most state programs focus on life sciences or innovation rather than being medical device-specific. Some states with strong MedTech ecosystems (Massachusetts, California, Illinois, etc.) typically offer grants, tax incentives, matching funds, or low-interest loans that are commonly used by medical device companies.

Is venture capital available for medical device startups in the U.S.?

The U.S. has a large and active MedTech venture capital (VC) ecosystem, so VC funding is available. This includes funding for early-stage and growth-stage investors. It’s important to note that VC funding is typically very selective. As a result, VCs often favor companies with strong clinical data, a clear path to regulatory approval, and commercial traction.

What role do corporate and strategic partners play in medical device funding?

Large medical device and healthcare corporations often support innovation through strategic investments, joint development agreements, pilot programs, and corporate accelerators. For startups and small medical device companies, these types of partnerships can provide capital, technical expertise, regulatory support, and access to clinical and commercial networks.

Are there accelerators or incubators focused on medical devices?

Yes, there are many MedTech-focused accelerators and incubators in the U.S. They are often affiliated with corporations, hospitals, or universities and typically provide mentorship, lab space, clinical access, and early funding.

Do nonprofits and foundations fund medical device projects?

Yes, especially disease-focused foundations, patient advocacy organizations, and health-oriented nonprofits. Organizations like this fund medical device projects that align with their mission. This type of funding may support things like prototyping, validation studies, or early clinical work.

How should a medical device company choose the right funding path?

The right funding path depends on the stage of development, regulatory status, capital needs, and long-term strategy. Many successful companies combine multiple sources of funding over time. An example is non-dilutive grants in the early stages of the project, followed by strategic partnerships or VC investment in later stages, as the risk of financial return is reduced.

Hands-On Support for Medical Device Development

Collaborating with a medical device development specialist at the start of your project can significantly improve your chances of securing capital. Although we don’t offer funding or financial consulting at Arrotek, we do provide expert design, development, and regulatory assistance, particularly in technical areas that will enhance your funding applications and investment pitches. Examples of areas where we can provide practical support include feasibility studies, product roadmaps, regulatory strategy, and realistic prototyping schedules.

How Arrotek Supports Your Vision

At Arrotek, we focus on assisting startups, clinicians, and entrepreneurs in transforming novel and innovative medical device concepts into scalable, market-ready products. Whether you are currently working on a proof-of-concept or a preliminary prototype, our experienced engineers and regulatory specialists can help create the technical data and documentation that investors and grant committees require.

Crucially, Arrotek does not claim any rights to your intellectual property (IP). We don’t ask for equity or investment stakes in your business either. When you partner with us, you maintain total ownership of your product and company while leveraging our specialist engineering knowledge, development resources, and ISO 13485-certified manufacturing space.

If you are navigating the initial phases of a medical device design project and want to ensure your technical files are ready for due diligence, contact us at Arrotek today. Simply complete the form below to start a conversation about your project.